High-Growth, High-Impact: Asset Management in Southeast Asia — April 15 2025

Enhance your company’s performance with tailored asset management strategies designed for high-growth businesses in Southeast Asia.

Traditionally, logistics was always classified in the cost bucket by businesses but with the advent of technology, mastering logistics has become the means of gaining a competitive advantage. [See — E-logistics — enabling the e-commerce supply chain with IoT]

Faster delivery, reduced delivery charges, easy returns, discounts, and cross-border purchases are the main attractions that drive consumer’s interest in the e-commerce industry. In order to give the final customers this value proposition while remaining profitable, tech-enabled e-logistics are gaining prominence in this business value chain.

Logistics systems are now an essential part of the e-commerce supply chain and the global e-commerce market is expected to total $4.89 trillion in 2021 making e-logistics an exciting investment ground.

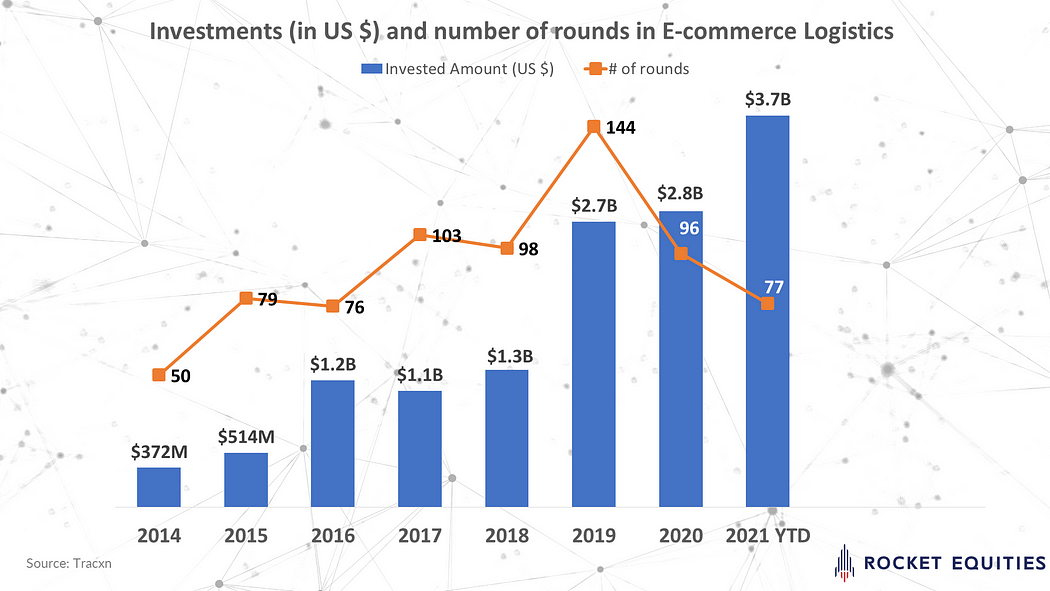

As shown in the figure above, the CAGR of the investment activities in the industry has seen an up to 36% increase in the last 3 years. The investment trend is also expected to boost in 2021 as a result of the economic recovery from COVID-19.

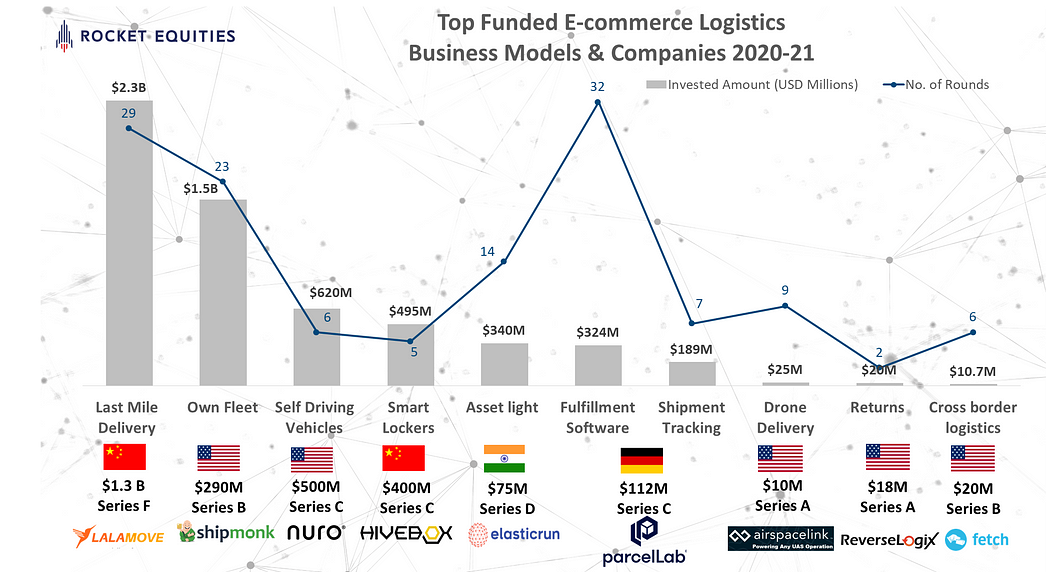

Among all the business models of e-logistics, last mile logistics are the most popular among the investors globally. Lalamove, a Hong Kong-based last-mile provider, raised US $515M Series E funding last December 2020 and Series F funding of US $1.3B in January 2021. SiCepat, Indonesian e-commerce last-mile logistics company has also raised US $100M Series B funding last December 2020, and another Series B funding of US$ 170B in January 2021.

Tech enabled business models like — E-commerce fulfilment software, and unconventional delivery modes like smart locker, drone delivery and self-driving delivery vehicles have also gained traction in the recent times. When we look at the funding activity in different segments of traditional logistics for the last decade as shown below, we notice that last mile logistics has always been the most favored segment among the investors as it plays the most important role in e-commerce deliveries.

Here’s a quick look at the different segments in logistics where the start-ups have raised funds from 2010–2019. While last-mile logistics has been the most popular segment among the investors with a total of US$ 9.9B, the road-freight marketplace has also attracted investor interest with total fundraising of US $6B.

Lalamove, has received a total funding of $2.3B and operates in cities across Asia and Latin America with 7 million users and a fleet of over 700,000 delivery drivers.

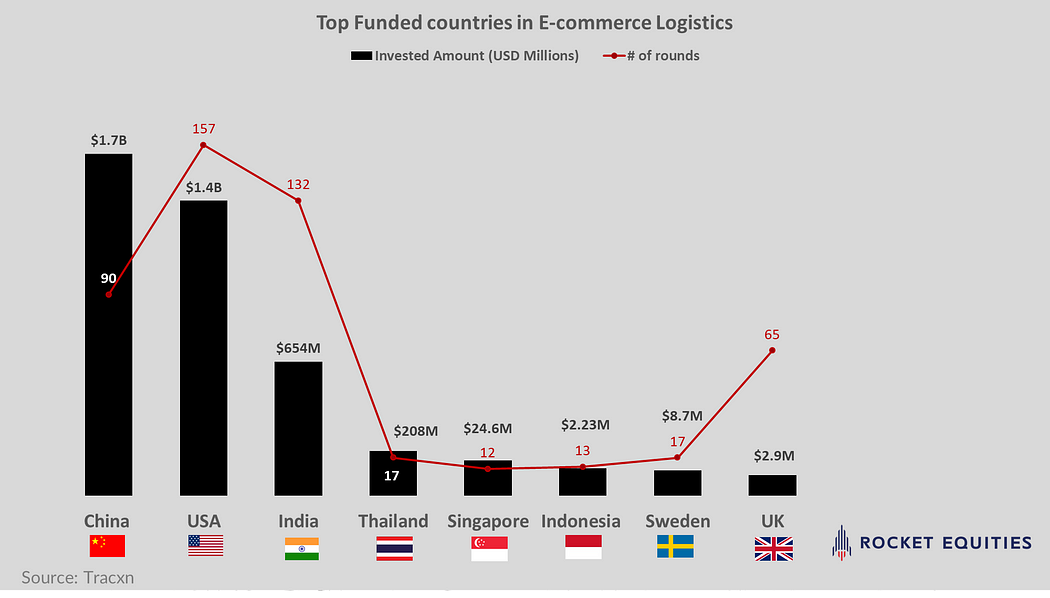

Some of the top-funded companies in e-logistics are based out of the United States of America with companies like Shipwire, Ohl, Deliverr, Shipbob, Slice, and Deliv bagging some of the biggest investments in the logistics industry. New-age technologies in e-logistics like Autonomous/Self-driving vehicles and drone tech delivery are some of the other sectors in which US-based companies dominate with Nuro alone bagging US $1B in its Series C Funding.

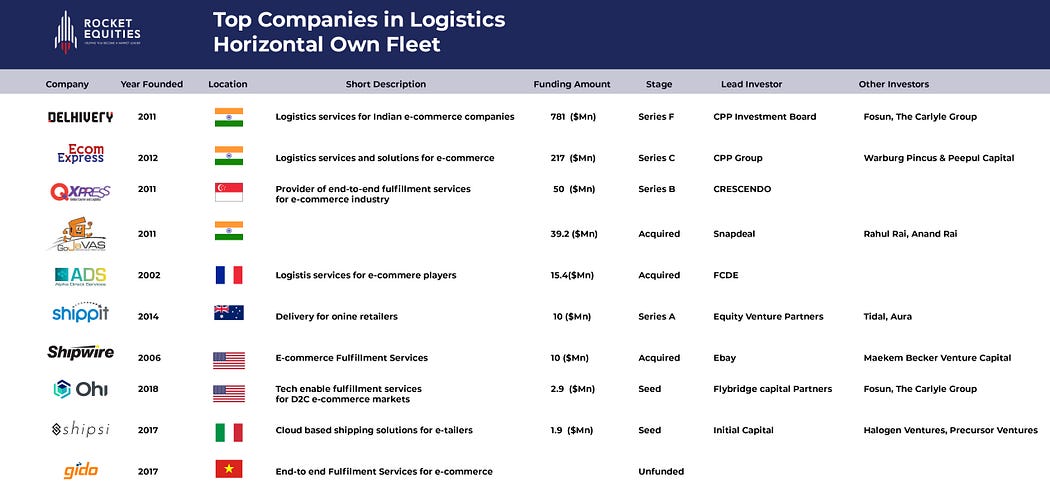

Indian companies like Delhivery, Ecom Express, GoJavas, Elasticrun, and Expressbees are some of the notable front runners that have excited the investors in the subcontinent. Some of the factors like domestic market size. the high volume of import/export transactions, rising consumer demand, and favorable market conditions make the Indian logistics market an interesting investment landscape. On the flip side, the consumer market is discount-driven and cost sensitive, with multiple brands competing for the market share which makes it a challenging market to maneuver.

Companies like Ninjavan, Qxpress, Shopee Express, and J&T Express are some companies from Southeast Asia that are garnering a lot of interest from global investors. These companies have been fulfilling the last-mile deliveries of the top E-Commerce marketplaces in Southeast Asia such as Lazada, Shopee, and Qoo10. Shopee Express is the in-house logistics of Shopee, and other marketplaces are also shifting towards creating their own logistics arms to control their own delivery quality and performance.

Countries like United Kingdom & Sweden with their tech driven logistics and new age technology are driving investments in their countries.

Israel has a deep-rooted interest in developing drone technology, FlyTech, an Tel Aviv-based start-up has made successful delivery runs for a variety of different products.

Australia has been experimenting with the point-to-point delivery network with companies like Hubbed and delivery service for online retailers with companies like Shippit.

E-logistics companies in Europe, Japan, and South Africa have also garnered investors interest in the recent times.

We have rounded up some of the top companies from each sector in logistics along with their recent fundraising activity.

In the next article, we will see how the logistics industry has been thriving in the Southeast Asian territory. The growth of e-commerce activities in Southeast Asian countries is booming as a result of the fast-paced economic growth, huge population base, and emerging adoption of technology.

Rocket Equities, a corporate finance and M&A advisory firm for fast-growing mid-sized companies in Southeast Asia.

Latest fundraising news on logistics from Rocket Equities — QuadX to raise $ 25 million to ride the e-commerce boom