High-Growth, High-Impact: Asset Management in Southeast Asia — April 15 2025

Enhance your company’s performance with tailored asset management strategies designed for high-growth businesses in Southeast Asia.

Fintech as an industry has evolved from a back-end system used by financial institutions a decade ago to a widevariety of tech interventions in personal and commercial finance. This has further been fueled by the change in consumer behavior globally post COVID-19 pandemic.

According to a study conducted by the Nielsen Company, the spread of the COVID-19 pandemic led to a globally manifested change in spending levels related to shopping activity. One of the changes in shopping activity is bundled product or service offerings which are becoming very unpopular because customers prefer to shop for the best deals on each item and convenience in shopping and other activities, this further reimposes that consumers are price-sensitive and hunt for good deals.

According to a study by PYMNTS, customers want to access a mobile application that combines several activities on a single platform. The survey found that 67% of respondents would like at least two activities integrated into a single platform.

Improved digital access in the last couple of years and the changing consumer lifestyle, has prompted a new trend to emerge — re-bundling products and changing consumer behavior.

The rising star that might be the driver for this new trend is the ‘Super- app’. As a result, the ‘Super-app’ is becoming a major disruptor in Southeast Asia’s consumer services ecosystem.

Super-app essentially serves as a single point of access for a wide range of products and services. A single app aims to give ease with one login and a seamless user experience across these products and services, allowing customers to have a ‘go-to’ place for whatever they need. The Super-app usually makes its mark with some combination of the following features:

Super-apps offer the benefit of a one-stop platform for multiple tasks. It is used for users that want to perform online. Users are much more convenient when accessing a single super-app than managing many individual apps. This is the main reason why super-apps are better than single-use apps.

By presenting together a range of services, functions, and experiences on a single platform that customers already feel confident using, Super-apps provide perfect experiences in keeping the users engaged and stickiness. In addition, by offering loyalty rewards, it encourages to conduct more of the users’ business on the super-app to maximize those benefits.

Led by the presence of companies, such as Grab and GoTo, Southeast Asia has witnessed the rapid development of super-apps over the past few years. This is partly due to the Covid-19 pandemic, which is pushing users to be more digital than ever before. Currently, Southeast Asia does not only have Grab and GoTo as Super-apps. According to Ipsos, the following is a list of Super-apps for each country in Southeast Asia:

Among the region’s super-apps, Grab appears to have the widest reach geographically. It includes all six Southeast Asian markets and has four or more services in six of these countries. While the mix of services differs from one Super-app to another, these companies have largely followed a similar playbook: build a vast network of active users around a core offering first then create an ecosystem of complementary services.

The rivalry between Grab and GoTo is no longer about cars and bikes hitting the streets. Instead, the competition between these Southeast Asia’s leading Super-apps just got more fierce, and both are getting new pressure from Southeast Asia’s other Super app, namely Sea Limited — and the competition between these three super-apps is more intensely oriented toward fintech.

The fintech space in Southeast Asia is incredibly dynamic with all of the traditional financial institutions, internet giants, and new upstarts that are making moves. Therefore, Super-app is a considerable opportunity to construct a valuable franchise similar to other global digital payments and financial services players, such as Alibaba’s Ant Financial, Paytm, Tencent’s WeChat Pay, and MercadoLibre’s MercadoPago.

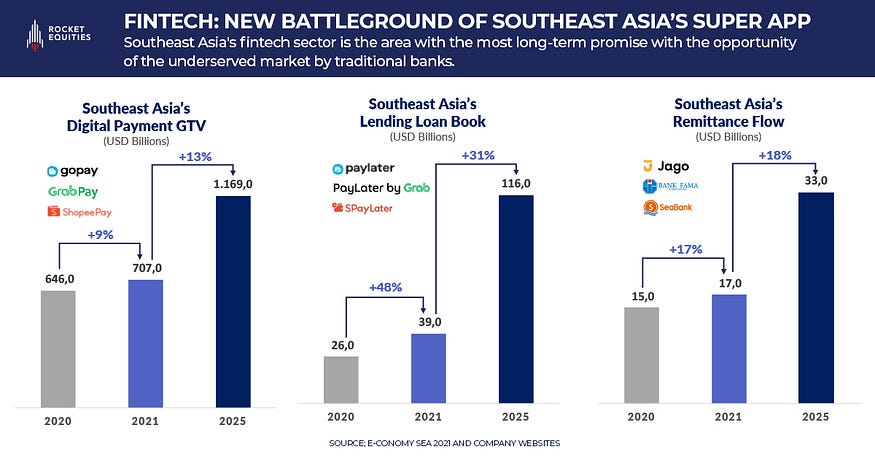

Southeast Asia’s fintech sector is the area with the most long-term promise since Southeast Asia is still relatively underserved by traditional banks compared with some other big markets. Southeast Asia’s digital financial services are flourishing, especially in digital lending.

According to the current e-Conomy SEA report by Google, Temasek, and Bain & Company, the Gross Transaction Value (GTV) of digital payments in Southeast Asia will reach US$1.169 billion in 2025. Furthermore, the value of remittance flows in Southeast Asia through digital financial services will be US$33 billion in 2025. Meanwhile, the value of lending loan books in Southeast Asia will be worth US$116 billion in 2025.

Grab and Sea Limited have digital bank licenses in Singapore, whereas GoTo has a stake in an Indonesian digital bank, namely Bank Jago. They could try to influence their digital-payment services to offer other financial services, for example, insurance and lending to the model used by China’s Tencent and Ant Financial, backed by Alibaba.

Grab’s plunder of financial services started in 2017. It occurred with the launch of the digital payments service of GrabPay. Nowadays, Grab Financial Group unit offers a growing list of offerings, such as insurance, wealth management, and buy now pay later. In 2019, Grab launched a GrabPay card in partnership with Mastercard, which could be used online and offline. To make the business grows, the company pushed its built-in customer base of drivers, consumers, and merchants in its ecosystem so it could advertise these services. Grab has now acquired a financial services license suite, including payments licenses for six regional markets.

Let’s take a closer look at how GoTo Financial and the fintech arm of GoTo Group provide wide-reaching digital financial solutions for all Indonesians, which is doing the same strategy as Grab in Singapore. GoTo Financial offers services across three main categories digital payments, merchant digitization, and consumer access.

GoTo Digital payment consists of:

GoPay: E-Money platforms to facilitate day-to-day purchases

Midtrans: Payment gateways

Gobiz Plus: Point-of-sale devices

Many customers and businesses in Indonesia are introduced to digital payment services by GoPay.

GoTo Merchant Digitalization consists of:

Moka: a cloud-based point of sale platform

Selly: a virtual keyboard

GoStore: an online storefront that connects the sellers to consumers through social media platforms

GoTo Financial’s services are empowering merchants across their digital journeys.

GoTo Consumer access consists of:

GoPay x Bank Jago: enables users to directly open a Jago bank account via the Gojek app, giving millions of unbanked Indonesians convenient access to banking services.

GoPayLater: Buy now, pay later services

The GoPayLater service serves most Indonesian consumers who don’t have credit cards.

Sea Limited does not want to lose to Grab and GoTo. Therefore, Sea Limited is also focusing on getting a piece of the pie in the fintech sector in Southeast Asia by establishing a subsidiary called SeaMoney. Through SeaMoney, Sea Limited offers financial services, including e-wallet services, payment processing, micro-lending, services related to digital financial and products that leverage the large user base, high-quality data on-platform demand, and operational efficiency across Sea’s ecosystem. These services and products can be found in Southeast Asia under AirPay, ShopeePay, Shopee PayLater, and other related brands.

Concerning Grab, Sea Limited, and GoTo, which are joining the market, Southeast Asia seems to be the following enormous region for internet services and fintech innovation. The fintech sector has become a critical part of the Southeast Asia Super-app growth story. It is a synergistic piece that creates value for the Southeast Asia Super-app by reducing payment friction and increasing customer lifetime value and stickiness. However, a considerable opportunity exists to create a much more valuable fintech franchise through opening an entire online-to-offline payment ecosystem and value-added financial services. Whichever becomes the Southeast Asia Super-apps market leader. In the end, it could deliver monster-sized returns as well. This puts its condition in a strong position to become one of the fintech trends that need careful attention.

E-commerce

Gaming & Esports

Rocket Equities is a Southeast Asia-focused financial advisory firm experienced in capital raising, M&A, and buy-outs.

Rocket Equities works with market leaders in tech and tech-enabled companies to raise capital in debt & equity markets, acquire competitors locally and regionally, and create an exit for founders by leveraging its network of 300+ professional investors composed of VCs, PEs, Corporates, and CVCs in APAC.